It was bound to happen, of course. The irrational exuberance about ‘China’s Century‘ has begun to abate. The New York Times has given extensive coverage to the problems of China’s legal system and government corruption, and these same two themes were also high-lighted in a critical survey of the country in the recent Foreign Affairs (subscription required). The Chinese stock market is not doing well, and parts of China may already be facing unexpected labor shortages.

Though China’s GDP growth of more than 9% last year was widely trumpeted in the press, there is widespread skepticism about China’s economic numbers. Actually, ‘widespread skepticism’ probably is an understatement. No one believes the figures of the Chinese government are accurate. There is some disagreement over the extent to which the central government deliberately skews its statistics, or whether the problem lies mainly with the lousy/corrupt reporting of the provincial governments. But whether Beijing’s National Bureau of Statistics is doing the best it can under difficult circumstances to report reasonably accurate numbers, or whether they’re just cooking the books to make the politicians happy, there is clearly something amiss with China’s stats, and the country’s economy might not be doing as well as its official numbers would lead us to believe.

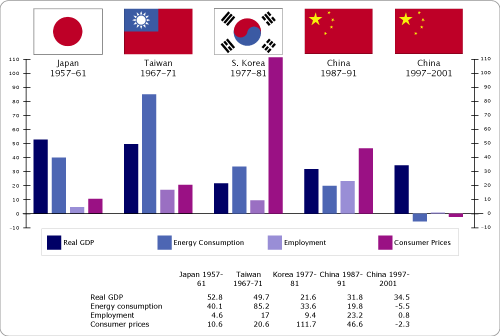

In a 2001 paper, Economist and historian Thomas Rawski of the University of Pittsburgh compared the official statistics of China to those of other Asian economies during similar periods of rapid growth. From 1997-2001 China reported a real GDP growth of more than 34%, yet energy consumption during the same period actually declined, along with consumer prices, while employment remained flat. Guessing at what China’s actual GDP growth might have been, Rawski says it might have been anywhere from 0.4% to 11%.

We’re going to be away for a couple weeks, but there will be more on this subject after we return.